#equity delta stock

Explore tagged Tumblr posts

Text

Global Market Highlights: December 16, 2024

European Markets

European equities began the day on mixed footing, oscillating between gains and losses as traders digested PMI data and geopolitical uncertainties. Sentiment weakened further as the session progressed, leaving most major indices in negative territory. The Eurozone’s latest PMI readings highlighted ongoing challenges, particularly in manufacturing, reinforcing the case for additional ECB easing measures. However, the data failed to spark significant market moves. Sector performance reflected a defensive bias, with healthcare leading gains, buoyed by Novo Nordisk's (+1.9%) approval for its Catalent acquisition. Autos were among the weakest performers, with Porsche SE (-1.7%) pulling the sector lower after withdrawing its full-year guidance. Meanwhile, US equity futures edged higher, indicating a slightly firmer start for Wall Street compared to Europe.

US pre-market

The final full week of 2024 began with US equities displaying remarkable resilience, outpacing declines in Asian and European markets. S&P 500 and Nasdaq futures surged to record highs, fueled by optimism surrounding upcoming Federal Reserve policy decisions. Bitcoin also reached a fresh all-time high of $106,000, bolstered by growing interest in cryptocurrency investments. As of 8:00 AM ET, S&P futures were up 0.3%, and Nasdaq futures gained 0.5%. This momentum was led by stocks such as MicroStrategy (+6% premarket), benefitting from its imminent inclusion in the Nasdaq 100. On the other hand, Super Micro Computer tumbled 15% following its removal from the same index during its annual reconstitution. Key Drivers - Anticipation of a Federal Reserve rate cut (expected 25 bps) on Wednesday. - Strong earnings expectations under a Trump administration economic agenda. - Resilient demand for US technology and cryptocurrency-linked stocks.

Fixed income markets

European government bonds (EGBs) faced selling pressure, with Bunds trading in a narrow range and slightly softer overall. Sentiment was influenced by mixed PMI data, with better-than-expected German services readings offset by persistent weakness in manufacturing. - French OATs underperformed following Moody’s unexpected downgrade of France's credit rating to "Aa3," citing political fragmentation and fiscal challenges. - Gilts saw minimal changes after the UK PMI release, with mixed data showing resilience in services but continued weakness in manufacturing. US Treasuries remained rangebound, with the focus shifting to this week’s FOMC meeting. Yields were marginally lower, with the curve flattening slightly.

Commodities

Crude Oil: Oil prices softened amid a risk-off tone, with Brent futures dipping below $74/bbl. The pullback reflected subdued sentiment in European markets and a lack of significant catalysts during the session. Gold: Gold prices climbed, finding support near $2,662/oz after an earlier dip to $2,643/oz. The rebound was aided by safe-haven demand amidst geopolitical tensions and mixed economic data. Base Metals: Copper and other industrial metals traded lower, weighed down by lackluster risk sentiment despite slightly positive industrial production data out of China. Key developments in commodities: - Marathon's Detroit refinery workers ratified a pay deal, ending a three-month strike. - Oil spills were reported in both Nigeria's Delta region and the Black Sea, adding to supply chain concerns.

Currencies

The US Dollar Index (DXY) remained steady within a narrow range, trading at the lower end of Friday’s levels as investors awaited US Flash PMI data and the upcoming FOMC meeting on Wednesday. - EUR/USD hovered near the 1.05 level, seeing choppy trade following mixed Eurozone PMI results. ECB President Christine Lagarde reiterated the central bank’s cautious stance, with her remarks offering little new insight. - GBP/USD strengthened, buoyed by better-than-expected UK Services PMI data, which pushed the pair to the top of its daily range around 1.2670. - JPY underperformed slightly, with USD/JPY trading above Friday’s levels at 153.79 as Japan’s PMI showed improvements in both manufacturing and services. - Antipodeans saw modest gains, led by NZD/USD, which outperformed AUD/USD after breaking Friday's highs. The Norwegian Krone also strengthened following Norges Bank's announcement to sell foreign currency and purchase NOK to fund government transfers.

Cryptocurrencies

Bitcoin soared to a record $106,000, driven by institutional adoption and increasing interest in crypto-related equities.

Political and World News

- South Korea’s President Impeached: South Korea’s parliament impeached President Yoon Suk Yeol, with 12 members of his party supporting the motion following his controversial martial law declaration. Prime Minister Han Duck-soo has assumed the role of acting leader as the Constitutional Court deliberates the decision. - Cyclone Ravages Mayotte: The French overseas territory of Mayotte suffered catastrophic damage from the strongest cyclone in over 90 years. Thousands are feared dead, with limited access to the affected islands hampering rescue efforts. - Israel-Ireland Diplomatic Rift: Israel announced the closure of its embassy in Ireland amidst escalating tensions over Ireland’s pro-Palestinian stance, which Israeli officials have condemned as biased. - ABC Settles Trump Defamation Case: ABC News (DIS) has agreed to a $15 million settlement over a defamation lawsuit filed by President-elect Trump. The network will also issue a public apology. - The Great Wealth Transfer: A staggering $124 trillion is expected to be passed down through inheritance in the U.S. by 2048. This unprecedented wealth transfer includes $62 trillion from the wealthiest 2% and is poised to reshape wealth management and luxury markets.

Economic Highlights

- Fed Rate Cut Expected: The Federal Reserve is widely expected to announce a 0.25% rate cut at its meeting this Wednesday. However, officials have signaled caution on further cuts due to persistent inflation and a robust labor market. - France's Downgraded Credit Rating: Moody’s downgraded France’s credit rating to Aa3, citing political instability and a ballooning budget deficit of 6.1%—double the Eurozone average. New Prime Minister François Bayrou faces challenges in addressing the country's $3.36 trillion national debt amid rising borrowing costs. - European Business Activity Stabilizes: The contraction in Eurozone business activity eased in December, with the services PMI rising to 51.4 and the composite PMI improving to 49.5, signaling slight stabilization despite weak demand for goods. - China’s Economic Indicators: China’s property market showed signs of stabilizing, with home prices declining just 0.1% in November, the slowest rate in 17 months. However, retail sales growth slowed to 3% from 4.8% in October, while factory output rose modestly. - India’s Private Sector Growth: India’s private sector output hit a four-month high in December, with its PMI rising to 60.7, reflecting robust demand across both services and manufacturing sectors. - Moody’s Downgrades France: Moody’s lowered France’s credit rating from Aa2 to Aa3, citing heightened political uncertainty and fiscal pressures. The outlook remains stable. - ECB Commentary: President Lagarde suggested further rate cuts are forthcoming, emphasizing that inflationary risks are now balanced. ECB’s Holzmann, however, cautioned against cutting rates purely to support growth.

Geopolitical Updates

Middle East: - Israeli Prime Minister Benjamin Netanyahu announced plans to expand settlements in the Golan Heights, citing strategic concerns amid the ongoing war. Meanwhile, Syrian media reported strong explosions near Tartous and Latakia, attributed to Israeli airstrikes. - The US reportedly conducted strikes against Houthi sites in Yemen, adding to regional tensions. US-China Relations: - Treasury Secretary Janet Yellen warned Chinese banks of potential sanctions over aiding Russia and discussed lowering the Russian oil price cap. South Korea: South Korean President Yoon Suk Yeol was impeached over his controversial martial law declaration, with Prime Minister Han Duck-soo assuming the role of acting president.

Corporate Highlights

- Broadcom Hits $1 Trillion Market Cap: Broadcom (AVGO) achieved a $1 trillion market capitalization, driven by a strong demand for artificial intelligence-related products. The company reported AI revenue growth of 150% year-over-year, reaching $3.7 billion in Q4. Broadcom’s stock has surged by an astonishing 760% since 2018. - MicroStrategy Joins Nasdaq 100: MicroStrategy (MSTR), known for its extensive Bitcoin holdings now valued at $45 billion, has been added to the Nasdaq 100 index. The company's shares have risen 550% year-to-date, closely tied to Bitcoin's performance, which hit a new record high of $106,509 over the weekend. - Novo Nordisk’s Expansion: Novo Nordisk (NVO) announced plans to invest $1.2 billion in a new facility in Denmark dedicated to producing treatments for rare diseases, including hemophilia. Shares rose 2% in premarket trading following the news. - Big Oil’s Pivot to AI Data Centers: Exxon Mobil (XOM) and Chevron (CVX) are set to use natural gas paired with carbon-capture technology to power AI-focused data centers. Meanwhile, tech giants like Microsoft (MSFT) and Google (GOOGL) are exploring nuclear energy options to meet the energy-intensive demands of AI. - T-Mobile’s Shareholder Returns: T-Mobile (TMUS) unveiled a $14 billion share buyback program through 2025, part of a larger $50 billion capital return initiative over three years. The company plans to allocate $80 billion toward shareholder returns and investments through 2027. - U.S. DOE Loan for EV Battery Factories: The Department of Energy finalized a $9.63 billion loan to Ford (F) and South Korean partner SK On to establish three electric vehicle battery manufacturing plants in Kentucky and Tennessee, advancing EV adoption in the U.S. - Amazon’s Warehouse Controversy: A Senate investigation found that Amazon (AMZN) ignored warnings linking its stringent productivity quotas to elevated workplace injury rates, which are nearly double the industry average. - Box Office Highlights: Disney's (DIS) "Moana 2" topped the box office over the weekend, grossing $26.6 million domestically, bringing its global total to $717 million. Meanwhile, Universal’s "Wicked" reached $500 million worldwide, but Sony's (SONY) "Kraven the Hunter" underperformed with a disappointing $11 million debut. - TikTok Legal Battle: A U.S. appeals court dismissed TikTok’s attempt to pause legislation requiring its parent company, ByteDance, to divest from the app by January 19 or face a ban. TikTok plans to escalate the case to the Supreme Court.

Recent Earnings Recap

There were no significant earnings reported today, but the full earnings calendar remains available.

Upcoming Earnings

Scheduled for Wednesday: - Micron Technology (MU): Expected revenue of $8.55 billion (+80.91% YoY) and EPS of $1.76. - Lennar (LEN): Projected revenue of $10.08 billion (-8.1% YoY) and EPS of $4.26 (-17.6% YoY). - General Mills (GIS): Anticipated revenue of $5.13 billion (-0.18% YoY) and EPS of $1.22 (-2.4% YoY). Scheduled for Thursday: - Accenture (ACN): Estimated revenue of $17.17 billion (+5.83% YoY) and EPS of $3.42 (+4.59% YoY). - Nike (NKE): Projected revenue of $12.47 billion (-6.86% YoY) and EPS of $0.83 (-19.42% YoY). - FedEx (FDX): Anticipated revenue of $22.14 billion (-0.27% YoY) and EPS of $3.95 (-1% YoY).

IPO Activity

- Health In Tech (HIT): A stop-loss health insurance marketplace with 231.93% YoY revenue growth, scheduled for Tuesday. - Leishen Energy Holding (LSE): A Chinese oilfield services company reporting 56.44% YoY revenue growth, slated for Wednesday. - Fast Track Group (FTRK): A Singaporean event-management firm with 2,589.48% YoY revenue growth, scheduled for Friday.

Market Outlook and Future Events

Markets are entering a pivotal week, with central bank decisions likely to shape the near-term trajectory for equities, bonds, and currencies. While US exceptionalism continues to dominate, weak Chinese data and European instability serve as reminders of the challenges facing global growth. Investors remain cautiously optimistic, betting on resilient earnings and accommodative monetary policies to sustain the rally into 2025. Read the full article

0 notes

Text

Hedging Strategies for a Volatile Market Introduction: The Market’s Mood Swings—and Your Survival Plan Imagine the Forex market as a caffeinated cat: unpredictable, lightning-fast, and occasionally scratching your portfolio. That’s a volatile market for you. But fear not, because today we��re diving into hedging strategies—your ultimate defense against those wild price swings. By the end of this article, you’ll be armed with insider secrets, advanced tactics, and a dash of humor to navigate turbulence like a pro. Let’s break down the chaos into manageable moves, from basic hedging principles to underground techniques the experts rarely share. Ready? Let’s make market volatility less of a horror story and more of a calculated chess match. Volatility 101: Why the Forex Market Feels Like a Soap Opera Volatility in Forex is like that friend who always shows up uninvited to parties—you can’t avoid it, but you can plan for it. Market volatility typically stems from economic indicators, geopolitical events, or central bank surprises. For instance, when the Fed whispers about rate hikes, the market reacts like someone dropped their latte. Pro Tip: To stay ahead of market-moving events, leverage real-time updates from StarseedFX Forex News. It’s like having an ear to the ground—or rather, the trading floor. The Hedging Blueprint: Protecting Your Assets Without Losing Sleep Hedging is not just for corporate bigwigs; it’s a tool every trader should have. Think of it as buying insurance for your trades. Here’s how you can apply this technique: A. Direct Hedging: This involves opening a trade in the opposite direction of your original position. For instance, if you’re long on EUR/USD but sense a storm brewing, you might open a short position to counteract potential losses. Insider Insight: Direct hedging can sometimes feel like wearing suspenders and a belt, but in a volatile market, redundancy is a lifesaver. B. Correlation Hedging: Use pairs with strong negative correlations to hedge your bets. For example, EUR/USD and USD/CHF often move in opposite directions. Holding positions in both can help offset losses. C. Options and Futures: Advanced traders can explore options contracts, such as buying puts to protect against downside risks. Futures contracts also provide a locked-in price to safeguard your trades. Underground Tactics: Little-Known Hedging Secrets A. Delta Hedging for Forex: Borrowed from the stock market, delta hedging involves adjusting your portfolio to neutralize directional risks. Use a mix of spot trades and options to create a delta-neutral position. This technique minimizes your exposure to sudden swings without closing out your trades. B. The Triangular Hedge: This strategy leverages the relationships among three currency pairs. For instance, EUR/USD, USD/JPY, and EUR/JPY can form a triangular relationship. By strategically balancing positions in all three, you can exploit price inefficiencies. C. The Hedge-and-Scalp Combo: Why hedge alone when you can profit simultaneously? After placing a hedge, use smaller scalp trades within the range to capture micro-movements. It’s like eating your cake and baking another one. Ninja Tactics for Spotting Volatility Before It Hits A. Economic Calendar as a Crystal Ball: Keep an eye on high-impact events, such as non-farm payrolls or GDP announcements. These are volatility’s favorite playgrounds. Tools like StarseedFX Economic Indicators offer detailed calendars and analysis. B. Volatility Index (VIX): While primarily for equities, the VIX can hint at overall market sentiment. A rising VIX often correlates with increased Forex volatility. C. Hidden Patterns in Historical Data: Analyze historical price data to identify recurring volatility patterns. Software like the StarseedFX Smart Trading Tool can automate these insights, saving you hours of manual work. The Psychology of Volatile Markets: Stay Cool When the Market Isn’t Volatility isn’t just a test of strategy; it’s a test of nerves. Ever hit the ‘sell’ button in a panic, only to watch the market rebound? That’s the emotional rollercoaster of trading. Here’s how to keep your cool: A. Stick to Your Plan: A robust trading plan acts as your lighthouse in a storm. Download a free customizable trading plan from StarseedFX. B. The Trading Journal Hack: Document your trades, decisions, and emotions to identify patterns. Think of it as therapy for your trading psyche. Get a free journal template at StarseedFX. C. Embrace Small Wins: In volatile markets, focus on incremental gains. Small, consistent profits often beat the high-risk, high-reward approach. Debunking Hedging Myths: What Most Traders Get Wrong Myth 1: Hedging Is Risk-Free Truth: Hedging mitigates risk but doesn’t eliminate it. Poorly executed hedges can compound losses. Myth 2: Only Pros Hedge Truth: Even beginners can benefit from basic hedging techniques. It’s about building confidence and protecting capital. Myth 3: Hedging Reduces Profits Truth: While hedging may cap gains, it also safeguards against catastrophic losses. Think of it as a safety net, not a straitjacket. Hedge Your Bets and Ride the Waves Volatile markets are like bad weather—inevitable but manageable with the right preparation. By mastering hedging strategies, from direct and correlation-based methods to advanced ninja tactics, you can turn volatility into an opportunity rather than a threat. Remember, the key to thriving isn’t avoiding risk—it’s managing it like a pro. Dive deeper into these strategies with StarseedFX’s education and tools, and turn those wild market swings into calculated moves. Got your own hedging tricks? Share them in the comments below—let’s trade smarter together! —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Hedging Vega Risks with Delta

Hedging Vega Risks with Delta Delta hedging is a risk management strategy used to neutralize the impact of price movements in the underlying asset of an option. It involves adjusting the position in the underlying asset to offset the sensitivity of the option's value, measured by its "delta." Delta represents the rate of change in an option's price relative to changes in the price of the underlying asset. As the price of the underlying asset fluctuates, the delta also changes, requiring frequent rebalancing of the hedge. Equity index option traders often use delta to hedge vega risks. This approach is feasible due to the strong negative correlation between the equity index and its implied volatility. Reference [1] formalized this practice by developing a so-called mean-variance (MV) delta. Essentially, the mean-variance delta is the Black-Scholes delta with an additional adjustment term. The authors pointed out, This paper has investigated empirically the difference between the practitioner Black-Scholes delta and the minimum variance delta. The negative relation between price and volatility for equities means that the minimum variance delta is always less than the practitioner Black-Scholes delta. Traders should under-hedge equity call options and over-hedge equity put options relative to the practitioner Black-Scholes delta. The main contribution of this paper is to show that a good estimate of the minimum variance delta can be obtained from the practitioner Black-Scholes delta and an empirical estimate of the historical relationship between implied volatilities and asset prices. We show that the expected movement in implied volatility for an option on a stock index can be approximated as a quadratic function in the option’s practitioner Black-Scholes delta divided by the square root of time. This leads to a formula for converting the practitioner Black-Scholes delta to the minimum variance delta. When the formula is tested out of sample, we obtain good results for both European and American call options on stock indices. For options on the S&P 500 we find that our model gives better results that either a stochastic volatility model or a model based on the slope of the smile. In summary, the new delta hedging scheme using the MV delta performs well for certain underlyings, even outperforming stochastic volatility models like SABR and local volatility models. Let us know what you think in the comments below or in the discussion forum. References [1] John Hull and Alan White, Optimal Delta Hedging for Options, Journal of Banking and Finance, Vol. 82, Sept 2017: 180-190 Post Source Here: Hedging Vega Risks with Delta via Harbourfront Technologies - Feed https://ift.tt/cRKmNCw November 20, 2024 at 07:09PM

0 notes

Text

Retail Bitcoin Frenzy: JPMorgan Predicts What’s on the Horizon

Key Points

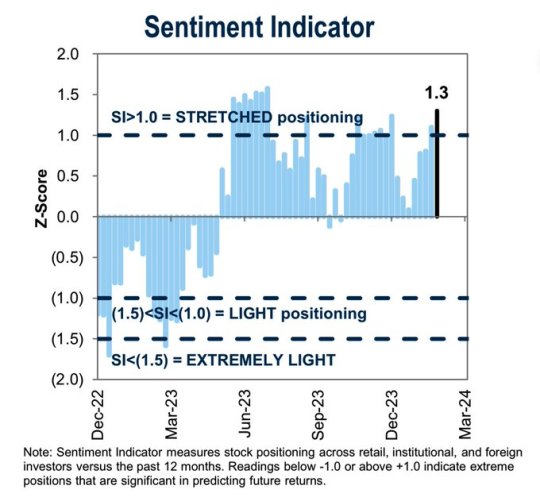

JPMorgan’s retail sentiment indicator suggests a frenzy in the Bitcoin market following the US Presidential elections.

Bitcoin-holder MicroStrategy sees bullish action, with its stock trading at a premium over Bitcoin.

Following the victory of Donald Trump in the US Presidential elections, Bitcoin and other altcoins have seen a significant surge.

However, JPMorgan has indicated that the market is in a state of frenzy and investors should prepare for potential volatility.

Record High Retail Sentiment Score for Bitcoin

JPMorgan’s retail sentiment score for Bitcoin soared to a record high of 4 shortly after Bitcoin’s price reached an all-time high of over $93,000 last week.

This surge was accompanied by strong inflows in US-listed spot Bitcoin ETFs.

JPMorgan’s equity research team noted that the demand for Bitcoin was especially strong following the election results, with the sentiment score for Bitcoin-related products soaring to a multi-sigma high.

In the latter half of the week, the outflows from spot Bitcoin ETFs increased significantly.

This, coupled with high Bitcoin miner selling, resulted in the Bitcoin price dropping to $87,000 before recovering to $90,000 over the weekend.

This indicates a tense battle between the market bulls and bears.

MicroStrategy’s Bullish Action

MicroStrategy, a major Bitcoin holder, has also seen a significant rally, with its stock hitting fresh all-time highs.

The MSTR stock has been trading at a substantial premium over Bitcoin for a while and continues to be in demand due to the company’s aggressive Bitcoin purchases.

The options market linked to MicroStrategy displayed an unprecedented bullish sentiment, reflecting the kind of intense trading typically seen near market peaks.

On Wednesday, the one-year 25-delta put-call skew plummeted to -26.7%, indicating that call options were trading at a significantly higher premium compared to puts.

Although the skew improved to -11.8% by Friday, it still shows a strong bias for upside bets.

Bitcoin calls have been trading at a much higher premium to the puts, but the differential has been slowly narrowing.

0 notes

Text

Toyota Invests Additional $500 Million in Joby Aviation for Electric Air Taxi Development

[Source – manufacturingtodayindia.com]

Strengthening the Partnership

Toyota Motor has announced a further investment of $500 million in Joby Aviation to support the development and commercialization of Joby’s electric air taxi. This new investment follows Toyota’s earlier contribution of $394 million, bringing the total to nearly $900 million. The funding is part of a strategic alliance aimed at facilitating Joby’s electric vertical takeoff and landing aircraft (eVTOL) production. The investment will be made through a purchase of common stock, with the first tranche set to close later in 2024 and the second in 2025.

Driving Sustainable Urban Mobility

Joby Aviation is leading the way in developing eVTOL aircraft, which are considered the future of urban air transportation. These aircraft offer a sustainable solution for overcoming modern mobility challenges by providing quicker, eco-friendly travel options. Toyota Motor North America CEO Ted Ogawa highlighted the potential of electric air taxis to address ongoing transportation issues, saying, “We share Joby’s view that sustainable flight will be central to alleviating today’s persistent mobility challenges.”

Joby is also making progress toward certification and commercialization of its electric aircraft. The company recently expanded its facilities in California, emphasizing its dedication to advancing urban air mobility.

A Deepening Collaboration

Toyota is Joby’s largest external shareholder, and both companies are collaborating closely on the project. Toyota engineers are working alongside Joby’s team in California, focusing on the development and production of key components for the eVTOL aircraft. Joby CEO Joe Ben Bevirt described Toyota’s involvement as crucial to the company’s long-term success. “This will further cement their incredible collaboration with Joby,” Bevirt said, emphasizing both companies’ commitment to revolutionizing daily transportation.

In addition to providing financial support, Toyota has signed a long-term agreement to supply essential powertrain components for Joby’s electric air taxis. This partnership is expected to play a pivotal role in shaping the future of air-based transportation.

Growing Interest in Electric Aviation

The electric air mobility sector has attracted the attention of several automakers and airlines. Stellantis, the parent company of Chrysler, recently announced an additional $55 million investment in Archer Aviation, another player in the eVTOL space. Airlines, including Delta Air Lines, are also exploring the potential of electric air taxis. In 2022, Delta invested $60 million in Joby for a 2% equity stake, with plans to offer air taxi services to airports in major cities like New York and Los Angeles.

As Joby continues to advance, its first commercial services could begin within the next few years, marking a significant milestone in the evolution of urban air transportation.

0 notes

Text

Market Comment

The Magnificent Nvidia market continues, yet NVDA may have left some near term exhaustion clues with Friday's close below its intraday volume shelf that also formed a daily doji candlestick. Weekly volume was great however, so any pullback, even a re-test of the 670 area, should likely be corrective. But I'm increasingly sensing NVDA's limelight could be waning.

It remains in a highly cyclical and competitive business, and there is the nontrivial possibility that NVDA's moonshot might simply be the result of pull-forward demand from frantic customers triple ordering chips Covid-style.

If so, and if momentum is indeed waning, even a simple correction could clip hundreds of points. There is even the May 2023 unfilled gap at 305.38 to contend with should it want to. A whopping 60.97 points wide. Some stocks barely move that much in a year.

Sentiment wise, upside call speculation has wildly skewed NVDA's options chain. Dealers, after selling those calls to buyers, neutralize their resulting negative delta by buying EQ and NQ futures, further adding to the upward pressure.

Notice the crowded long positioning, via Goldman. This will end only when animal spirits cease for whatever reason.

Speaking of sentiment, Private Equity is still up to its old tricks.

KKR-Owned April Seeks Traditional Loan to Refinance Private Deal

French insurance broker April Group is turning to traditional lenders for a €1.2 billion syndicated loan to help refinance debt that it took out from private creditors just over a year ago. ~Bloomberg

Debt to refinance debt, yet again.

And, ICYMI, investing has gotten so easy that The Whiz Kids are back.

These Teenagers Know More About Investing Than You Do

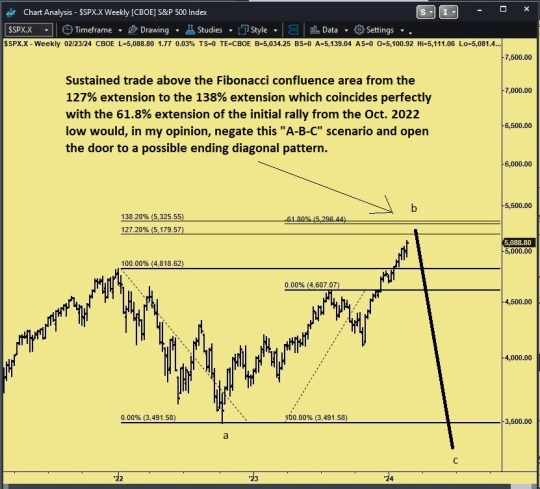

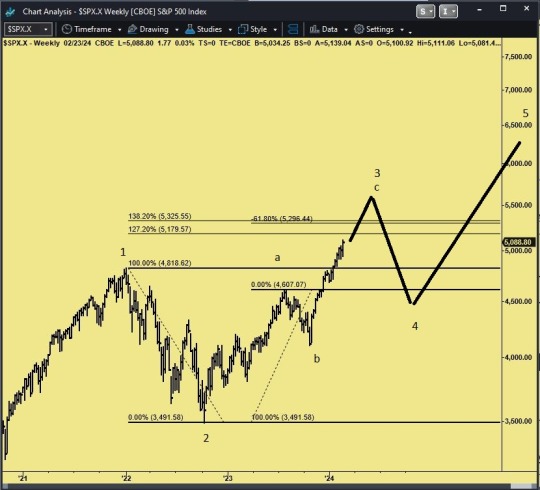

Regarding the S&P 500, the clock is ticking on the B-wave thesis. The usual target of an overthrow such as this is the 127% Fib extension (5179.57). Yet just above is a juicy confluence area, 5296.44-5325.55.

Any sustained trade above 5325.55 would trigger, for me, a different scenario: an ending diagonal.

The ending diagonal scenario interests me because it would explain the "relentless" nature of the current rally -- relentless being an unconscious social mood description of third waves that I have noticed over the years (and it might not be finished yet).

An ending diagonal would also provide for a re-test of the SPX 4400 "November 13th" area that has been previously covered here at Mood Report with the charts of UPS, NKE, FDX, and now PANW.

For now I play only with options -- NVDA call spreads against very short-dated SPY puts and OTM NVDA puts.

NVDA now has a $2T market cap and a 50% Implied Vol, multiples higher than its peers, which effectively makes it the most dangerous stock in the market.

Caveat emptor.

0 notes

Text

PBAT Achievements at a Glance-7months Year End 2023 - Dr Kenny Odugbemi

PBAT achievements at a glance-7months year end 2023

PBAT Achievements at a Glance-7months Year End 2023 PBAT has stabilized the polity and reduce tension associated with ethnics and religious bigotry to better managing our diversity, whist ensuring balance spread of appointments across different regions to further reduce tension on perceived marginalization with attendant emergent of IPOB, Niger-delta- militants, Oodua, Arewa consultative forum IPOB and Yoruba Nation calling for secession Other notable achievements includes not limited to the following ✓Renew commitments in war against insecurity Waging fierce war against corruption ✓Introduction of different level of palliative cutting across regions and demographics with peculiar needs ✓Introduction of discipline and control, transparency in CBN ✓Cementing fractured relationship with Work powers ✓Accentuating and prioritizing regional Cooperation with African sub-region and encouraging build up of AFCTA agreement ✓Returning dignity to body of politics - intervention of Ondo and River state saga ✓Attracting several FDI's and contract sealed many trade agreement across Europe covering all sectors ✓Removal of fuel subsidy first day in office -very audacious ✓Unification of exchange rate ✓CBN halt injection of usual $1.5bn monthly in capital markets and now paying backlogs ✓Deregulation of power and rail services- exclusive list to concurrent for State equity participation ✓Instituting President Tax review backed up by executive orders, bills waiting for review at upper and lower house to become law before implementation ✓Relaunch of PH refinery with capital expenditure of $1.5b ✓Social intervention support of N2b to 36 states including Abuja to cushion effect of subsidy ✓Support for manufacturers, Start up and Nano enterprise at single digit 9%annually ✓Created additional 10 MDA's to facilitate new streams of revenue and foster professionalism across all the sectors ✓Setting service delivery unit to better manage all 29+ MDA'S with KPA's and KPI'S ✓Removal of ASSU from IPPS to better managing Nation tertiary institution s ✓Not borrowing more fund for National projects- adopting PPP initiatives ✓improving primary health across 36 states + Abuja through contract agreement with major global development partners it ✓ launching of credit facilities at single digit across board to reduce civil services corrupt tendencies *Economic vitals ✓Increase in Nigeria stock market by 34.11% ✓GDP - +2.54% ✓Oil production rise by 13.4% ✓Balance of trade in surplus of 52% highest in 5years ✓External debt -$41.59b ✓Pension fund aggregate-N77trn ✓Recovery of N12trn out of N33trn declared in CBN audit report ✓Public debt -N87.91trn ✓inflation-28.2% ✓Food inflation-31.5% ✓Divestment of multi nation P&G,GSK and other -$4.5b ✓ devaluation of Naira by 41% Read the full article

0 notes

Text

tastytrade: The Ultimate Platform for Trading Options and Futures

tastytrade, formerly known as TastyWorks, offers multiple trading options, including options, futures, stocks, ETFs, commodities, and indices. It is also best suited for traders interested in honing their skills in other trading areas, such as crypto. tastytrade features and functions are designed keeping in mind the needs of all active traders; however, it is mostly suitable for professional futures and options traders.

Beginners can check out the excellent research tools and educational content offered by tastytrade, but the lack of investment selections and the low pricing structure may not be suitable for passive and casual traders.

In this tastytrade review, we will discuss the tastytrade platform’s features, trading products, fees and commissions, deposits and withdrawals, and security measures employed. So, let’s find out why tastytrade is considered the ultimate platform for trading options and features.

What makes tastytrade the best in the market?

The tastytrade trading platform provides the best platform without upsell, bots, or endless wait times. Traders can get a good deal with low commissions, important financial tools, and an easy-to-use platform with advanced risk analysis tools and real-time quotes.

tastytrade caters to active traders who deal with futures and options trading, offering them affordability and robust research tools, making the platform enticing for options and futures traders. The features on tastytrade web desktop and mobile platforms are fully customizable, including position details, watchlists, and trading page details like volume, theta, and delta.

The platform mainly specializes in stock, options, and futures trading, providing traders with a range of offerings, including singles and multi-leg action, contracts, commodities/futures, ETFs, treasury, bills, and even cryptocurrencies. It uses a smart auto-routing system that focuses on price movements and orders in quality. In addition, tastytrade also has interactive and complex charting tools with notable enhancements, allowing trades to create chart configurations outside the main dashboard.

tastytrade Trading Products

Since tastytrade is primarily built for futures and options traders, it has a slightly limited range of offerings compared to other online brokers. However, traders can also find other trading products besides options and futures – stocks, ETFs, commodities, and indices.

The range of trading products on tastytrade allows traders to find the best opportunities in various market conditions and choose their products wisely based on their investment objectives, risk tolerance, and financial standing. Under options trading, tastytrade offers stock options, ETF options, and index options.

The futures trading segment exposes SMFE and CME futures, including equity index futures, interest rate futures, foreign currency futures, energy futures, metals futures, agricultural futures, volatility, cryptocurrency, and livestock futures.

There is also an option of options on futures trading that gives investors the power to buy and sell futures contracts at specific prices. Futures options give greater returns on capital since the futures are leveraged.

tastytrade Fees and Commissions

Traders always seek lower and lower commissions, giving them more freedom to trade efficiently. tastytrade has introduced excellent rates for traders to open their trades and close them even at a better price. The opening and closing commissions have been mentioned in the table below –

Trading Products

Opening Commission

Options on Stock & ETFs: $1.00 per contract ($10 max per leg)

Options on Futures: $2.50 per contract

Options on Micro Futures: $1.50 per contract

Stock & ETFs: $0 unlimited shares

Futures: $1.25 per contract

Micro Futures: $0.85 per contract

Smalls Futures: $0.25 per contract

Closing Commission

Options on Stock & ETFs: $0

Options on Futures: $0

Options on Micro Futures: $0

Stock & ETFs: $0

Futures: $1.25 per contract

Micro Futures: $0.85 per contract

Smalls Futures: $0.25 per contract

Options

Stock & ETFs: $10 max per leg

Futures: $0

Cryptocurrency: 1% of total cryptocurrency purchases and 1% of total cryptocurrency sales

tastytrade Deposits and Withdrawals

Funding a tastytrade trading account is simple and can be done in the most stress-free way, paying very little to no additional fees depending on the payment method chosen. Traders can deposit funds online or in the old-fashioned way via the following methods – transfer accounts, bank transfers, wire transfers, and checks. One of the best things about the tastytrade trading platform is that there is no minimum requirement for deposits and withdrawals.

tastytrade Security

tastytrade prioritizes the security of client information and funds on the platform since trading involves the investment of huge sums of money. The security measures employed by the tastytrade platform are top-notch, including the availability of two-factor authentication via apps and SMS, face recognition and fingerprint, and excess SIPC (Securities Investor Protection Corporation) coverage. Moreover, tastytrade has not reported any major security breaches or experienced outages during its operation.

Conclusion

To conclude this tastytrade review, the trading platform is designed for active traders primarily interested in trading derivatives, including futures, options, and options on futures. It is an excellent place for beginners to hone their skills and develop knowledge to analyze the risks and rewards involved in options and futures trading strategies.

However, for serious and professional traders, there is plenty of unique content, attractive pricing, and useful tastytrade tools to access the financial markets and participate in trading. In addition to this, since there is no monthly fee, minimum deposit requirement, account opening charges, or inactivity fees, tastytrade can be tried out seamlessly by both beginners and professional traders.

1 note

·

View note

Text

How to Trade in Futures and Options?

Trading futures and options is a lucrative but complex endeavor involving speculative bets on the price movements of various assets like commodities, stocks, and currencies. The trading mechanisms, contracts, and strategies for futures and options are distinct, but both offer the chance to hedge against market risks or gain from market movements. Maheshwari Institute's Advance Trading Strategies is an ideal starting point to learn futures and options trading for those intrigued by the potential for high rewards but hindered by the complexity. This course offers a deep dive into the mechanisms and strategies you need to trade successfully in these financial derivatives.

The course starts with "Options Trading Strategies for Equity, Index, and Currency," where you will engage in option chain analysis, touching upon topics like Put Call Ratio, Open Interest Analysis, and more. You'll also study different options strategies, including Bull Spread, Bear Spread, and Straddle. The course provides a detailed look into option Greeks like Delta, Gamma, Theta, Vega, and Rho.

As you proceed, you'll have the opportunity to learn futures and options trading strategies specific to indices like the Nifty Bank, Nifty 50, and Nifty Financial Services. The second module covers "Advance Trading Strategies for Equity, Commodity, and Currency," you will learn about price action trading using Heikin Ashi Candles, scalping, and reversal trading strategies employing Bollinger Bands. The third module focuses on the Elliott Wave Theory, giving practical insights into its application in live markets.

This course is tailor-made to provide experienced traders with the knowledge and skills to excel in the vibrant world of futures and options. To maximize your trading potential, don't hesitate to enroll and learn futures and options trading through Maheshwari Institute's comprehensive course.

Why is Maheshwari Institute the right choice?

Maheshwari Institute stands out for multiple reasons for those who want to learn future and option trading.

The Institute boasts an impressive track record, having trained over 10,000 candidates in various aspects of trading and investment. Furthermore, they have successfully placed more than 1,000 students in reputable firms, reflecting the courses' quality and employability.

Adding to the Institute's credibility are the numerous corporate training sessions and seminars they have conducted, which not only widen the student's exposure but also allow them to network with industry experts.

Last but not least, the Institute provides hundreds of internship opportunities, allowing students to gain practical experience and better understand the real-world applications of their training.

Ready to learn futures and options trading? Find out more about Maheshwari Institute's Advance Trading Strategies program here.

Source URL: https://maheshwariinstitute.com/blog/how-to-trade-in-futures-and-options/

0 notes

Text

Learn Stock Market Courses in Ahmedabad and Register Free for this Share Market Courses for Trading at Our Training Institute in Ahmedabad

Learn and implement practical strategies by joining the Stock Market Courses in Ahmedabad. Money Plant Trading Academy is launching Share Market Course in Ahmedabad.

Importance of Stock Market Courses in Ahmedabad

The stock market is the backbone of any economy and therefore is an everlasting field. Many youngsters now returning to the stock market and willing to make a full-time career in the same. People think that from the stock market anyone can earn fast and easy money, and here is what everyone is mistaken about. This is where Share Market Training is needed and Share Market Course to learn. The stock market is not a gambling game it’s the place where trading is done on the basis of the rule set by a regulatory body. In India SEBI (Securities and Exchange Board of India) is the stock market regulatory authority. People who want to enter into stock are advised to get proper Share Market Training in Ahmedabad so that they get to know about all the rules and regulations of the stock market. There are various Stock Market Courses in Ahmedabad and in the other cities of India available. Share Market Course in Ahmedabad give you the proper way of trading. You learn many trading strategies through the Stock Market Training Courses in Ahmedabad.

What will you Learn from Stock Market Courses in Ahmedabad ?

Even if there is a risk involved in the stock market, with the proper training from the Share Market Course in Ahmedabad one can earn a significant profit. The risk factors depend on one's willingness to accept a profit or loss. Many people do trading at their part-time business to make extra money. However, having fundamental knowledge is necessary to earn some profit and avoid the chances of loss. In Stock Market Courses in Ahmedabad, you will get to learn various stock market strategies and implementation. You will learn the techniques of trading and the tactics of reducing the risk. The curriculum of

The Stock Market Courses in Ahmedabad include an introduction to the capital market i.e. Primary Market, Secondary Market, Advance Technical Analysis, trading basics Understanding of Candlesticks & Indicators, etc

Money Plant Trading Academy’s Share Market Course in Ahmedabad

On a heavy demand by the learners from Ahmedabad Money Plant Trading Academy has recently started its franchise. The main reason behind starting Stock Market Courses in Ahmedabad is to share knowledge and to teach the delta trading strategy to learners. Delta trading is the strategy with which traders can control the directional risk of their portfolio. Money Plant Trading Academy has separate PRO classes to teach delta trading. Traders having at least 15 months of trading experience are eligible to attend the Delta Neutral PRO classes. Because the tricks given by our expert trainer are only be understood by the experienced traders. If you are new to trading then Money Plant Trading Academy has a basic Equity Derivative trading course to help you kick start your trading career. There is hardly any Share Market Course in Ahmedabad that teaches delta trading.

What Facilities will you Get in Money Plant Trading Academy’s Stock Market Courses in Ahmedabad ?

Learners get the following benefits from Money Plant Trading Academy

Money Plant Trading Academy provides full-fledged online training so that learners can attend classes from the comfort of their homes.

Free study material

Teaching in Hindi and Ahmedabad also so that language could not become a barrier in the process of knowledge earning

Recorded video lectures so that if any lecture got missed learners don’t fall behind.

Dedicated attention toward each learner.

Class tests in between the course to check the understanding of the learner

Live trading environment.

Initial trading guidance

Trading desk facility

Exclusive trading secretes from the derivative market expert

Course completion certificate

There are more Share Market Training Branches of Money Plant Trading Academy in Ahmedabad

Other than Stock Market Courses in Ahmedabad Money Plant Trading Academy has it’s headquarter in Ahmedabad. This Stock Market Training Course is one of its kind. He has years of derivatives market experience and is a very successful derivative trader of his time. The secret behind his success is the directional trading approach i.e. Delta trading. Delta trading is not so popular but it surely has the potential of reducing the risk and maximizing the returns. Money Plant Trading Academy’s share market course at our training institute in Ahmedabad focuses on teaching delta trading followed by basic equity trading. So for now Money Plant Trading Academy is conducting a Stock Market Courses in Ahmedabad.

#stock market trading#stock market#stocktrading#stock maket news#stocks to buy#investing stocks#training#learn more#learning#education

0 notes

Text

Let’s Goooooooo

I am excited to join the newest IYA cohort and learn from and with you all. I am a finance professional with experience in stock market, corporate equity and FP&A world. I also have extensive experience in the DEI/ERG space and executive coaching with an emphasis on inclusivity and thought leadership.

My goal is to always activate the right and left side of my brain while allowing space for my heart/passions to exists in every room I walk in and with every exchange I have.

My creative expressions include dance, learning about technology and how it impacts the macro economy, 3D design, engaging in community service, participating with my sorority (Delta Sigma Theta Sorority, Inc.) and growing with my beautiful family (Tj - husband, Myjoi -13yo daughter, Khari 3yo son).

I am looking forward to meeting and building with you all! Shoutout to the leaders of NOW!

2 notes

·

View notes

Text

Momentum in the Option Market, Part 2

Momentum is a widely observed phenomenon in the stock market that refers to the tendency of stocks that have exhibited strong price performance in the past to continue performing well in the future, and vice versa. The momentum effect suggests that stocks experiencing upward price trends tend to attract further buying interest, leading to additional price increases, while stocks on a downward trend tend to experience continued selling pressure, resulting in further price declines. This phenomenon is often attributed to various factors, including investor psychology, market trends, and herding behavior.

Momentum is not limited to the equity market alone; it also manifests in the option market. As we have previously discussed, delta-hedged straddle option positions have shown evidence of exhibiting momentum. Recently, in Reference [1], further research has delved into exploring momentum within the option market by extending the analysis to include option factors. The authors pointed out,

In this paper, we extend tests for factor momentum to the options markets, relying on a novel set of 56 factors based on sorts of daily delta-hedged call options. We find corroborating evidence for both the existence of factor momentum and its explanatory power for momentum in the factors’ underlying assets: First, time-series and cross-sectional factor momentum strategies are profitable. Their returns are distinct from returns of an equally-weighted factor portfolio and robust to the factor model of Horenstein et al. (2020). Second, strategies relying on a one-month formation period are largely driven by factor autocorrelation. However, the longer the formation period, the more important are high mean factor returns and their persistent variation as momentum drivers. Third, as in Ehsani & Linnainmaa (2022) and Arnott et al. (2023), momentum effects are the strongest in the option factors’ largest eigenvalue principal components. Fourth, and extending the findings in Heston et al. (2022) to single option returns, we find momentum at the option level. Spanning tests suggest that option factor momentum subsumes option momentum and not vice versa.

This study presents additional insights into how momentum can influence options. By understanding and harnessing momentum in the option market, investors can potentially enhance their trading strategies and optimize their risk-return profiles.

Let us know what you think in the comments below or in the discussion forum.

References

[1] Käfer, Niclas and Moerke, Mathis and Wiest, Tobias, Option Factor Momentum (2023), https://ift.tt/OH1Fje2

Post Source Here: Momentum in the Option Market, Part 2

from Harbourfront Technologies - Feed https://ift.tt/TWfanpd

0 notes

Text

He turned consensual sex into rape at least three times, twice involving choking them. Then he posted a video to cancel cops. This is why while I agree with calls to reform, retrain, restructure the police I will never support getting rid of the police. To many violent men would benefit.

UPDATED: Shares of Penn National Gaming fell more than 20% Thursday, after the publication of an article in which several women alleged that they had “violent and humiliating” sexual encounters with Dave Portnoy, president of Barstool Sports. Penn National, which operates casinos, racetracks and online sports betting, owns a significant equity stake in Barstool.

The drop in Penn National’s stock price also came after the company missed Q3 earnings expectations. Revenue climbed 34%, to $1.51 billion, but net profit dropped 65% to $86.1 million (52 cents per share), well below Wall Street average forecasts of EPS of 85 cents. The company shares opened -4.6% after the earnings report was issued Thursday morning.

In a nearly 4,000-word Insider story, three women said they had sex with Portnoy and that the encounters “turned into frightening and humiliating experiences that have taken a toll on their mental health.” Two of the women said Portnoy both choked and filmed them without permission, per the report.

Portnoy responded in a pair of videos posted to Twitter, in which he denied the allegations in the Insider article. According to Portnoy, he has never been criminally charged in connection with any sexual encounter.

“I’ve never done anything weird with a girl, ever, never anything remotely nonconsensual,” he said in part, calling the Insider report a “hit piece.” He also said, “Cancel culture has been coming for me for a decade. This is just the next iteration.”

In a statement, a Barstool Sports rep said, “We are not in the business of managing our employees’ personal lives, but we have made sure to have specific processes in place that encourage our colleagues to confidentially share any concerns they might have about their work environment. This recent news does not involve any workplace behavior. As a matter of policy, we do not comment on the private lives of our employees, but we take this matter seriously and are monitoring it closely.”

According to the Insider article, one woman texted a friend two days after having sex with Portnoy at his Nantucket home, saying, “It was so rough I felt like I was being raped he video taped me and spit in my mouth and choked me so hard I couldn’t breathe.” She also told her friend, according to the Insider report, “And it hurt and I was literally screaming in pain… I kept trying to get away and he was like, ‘Stop running away from me. Stop running away from me.'” But despite her protests, Portnoy ���just went harder,” according to the woman, who was identified as “Madison” by Insider.

Portnoy, who calls himself “El Presidente,” in the past has made “rape jokes,” according to the Insider report. In July 2020, the article noted, he posted a video that offered women tips for how to “how to slide into a celebrity’s DMs” (meaning his own DMs): “Be very hot. Don’t be ugly. And say this, two words: ‘I fuck.'”

Penn National Gaming’s stock closed down 21.1% on Nov. 4, to $57.40 per share. The company’s market capitalization lost about $2.6 billion in value on Thursday’s decline. In announcing Q3 results, Penn National blamed the earnings miss on the impact from Hurricane Ida and regional flareups of the COVID-19 delta variant.

A rep for Penn National Gaming did not respond to a request for comment on the Insider article.

In January 2020, Penn National Gaming paid $163 million for a 36% stake in Barstool Sports, with previous owner the Chernin Group left with the same percentage stake. Portnoy had sold majority control of Barstool to Peter Chernin’s Chernin Group in 2016. In an interview last year, Jon Kaplowitz, head of Penn National’s interactive division, said “we have done our due diligence” and that the company is “confident” that Barstool has “the right guardrails in place.”

Founded in 2003 as a sports blog, Barstool has diversified its business over the last several years, expanding into podcasts, merchandise and wagering with Barstool Bets, its site for sports betting and gambling entertainment.

Barstool has a sizable fanbase with its brash brand of sports commentary, while critics have targeted the site over past sexist and racist content. In 2020, Portnoy posted a defiant video hitting back at “cancel cops” who resurfaced clips of him using racist language including the N-word in past videos, complaining that they took video from the “comedy site” out of context. “I’m uncancellable,” he said. ESPN in 2017 canceled “Barstool Van Talk,” a late-night comedy/interview show on ESPN2, after just a single episode aired. That came after ESPN correspondent Sam Ponder called out sexist attacks against her by Portnoy and other Barstool staffers.

#Dave Portnoy is a rapists#Penn National Gaming#Barstool#Dave Portney is racist#ESPN did the right thing to cancel his show#Abusers using woke language to attack cops.

3 notes

·

View notes

Text

Getting Off Life Support

Getting Off Life Support

Monetary authorities both here and abroad feel more confident in future economic growth as we are finally getting our arms around the Delta variant. Openings can accelerate once again.

They are on the brink of slowly removing extraordinary measures such as buying $120 billion of bonds here and nearly $100 billion abroad per month. This is excellent news as it is a vote of confidence that better days are ahead, so it’s time to get off life support and return to standard monetary policies. Tapering is not tightening, and even when they begin to hike rates, it probably won’t be until 2023, and the “real” funds rates will likely remain negative, which won’t put the brakes on growth.

Monetary authorities realize that their policies cannot impact shortages and supply line issues which penalize economic growth while boosting inflation. Investors have not appropriately factored into their forecasts what the other side will look like after these problems abate. We see much higher production rates as pent-up demand is filled and inventory levels are normalized. We see higher operating margins, profits, and cash flow as extraordinary costs normalize next year, for example, transportation expense. S&P operating margins are forecasted to hit close to 14% by the end of 2023, up from 12.1% in 2019, and earnings could exceed $235/share up from $162/share in 2019.

While we remain positively inclined to equities over the next 12 to 24 months, uncertainties persist, keeping a lid on markets for now. While monetary policy is more in focus, fiscal policies here and abroad are still in the air. And we still need to vaccinate the unvaccinated! Our government is dysfunctional, and China needs to take a more proactive role over Evergrande, a problem caused by their own monetary and fiscal policies. It will take many months for shortages and supply line issues to diminish. Still, the other side looks better by the day as global liquidity continues to build; we expect a surge in capital spending supported by governments everywhere, and inflationary pressures subside.

Let’s look at the key issues facing investors.

News on the Delta outbreak continues to improve by the week. The number of new cases has declined by 12% here and abroad over the last 14 days, while deaths, which lag, continue to increase here but are still falling abroad. More than 6.03 billion doses have been administered worldwide across 184 countries at a daily rate of 31.5 million doses per day. In the U.S., 387 million doses have been given so far at an average rate of 750,942 doses per day. Infectious disease experts that vaccinating 70-85% of the population would enable a return to normalcy which should be reached globally within six months. Fortunately, Pfizer, Moderna, and J&J will have enough doses available to handle globally even booster shots next year. We learned last week that the FDA panel recommended booster shots for ages 65 and up as well as those in need and that J&J’s booster shot provides 94% protection two months after the first dose. All good news. Hopefully, drug companies come up with a combination flu/coronavirus shot within a year.

The Fed took a more hawkish view gaining control over the narrative in their meeting last week, commenting that tapering is ready to begin now, although raising rates is well down the road. The financial markets took it in stride as the Fed will continue buying hundreds of billions in debt over the foreseeable future. The “real” funds' rate will remain negative for many years, which is anything but restrictive. Fed Chairman Powell said all the criteria to begin tapering were “all but met,” implying that it would be announced and start in November and be finished by mid-2022. We still do not see a rate hike until 2023 and we question the Fed’s trajectory of hikes into 2024. While no one knows when shortages and supply issues diminish, we are confident that inflation, on the other side, will be a positive surprise as productivity gains will be solid, benefitting from the surge in technology spending and operational changes made during the pandemic. Flows from abroad arbitraging rates continue to limit the steepening in our yield curve, which supports our markets.

What can be said about our political system other than it is dysfunctional? Everyone agrees that we need a sizeable traditional infrastructure bill, so why tie it to a social agenda and a debt ceiling? Passing the debt ceiling should be a non-event, too, but here again, the Dems are holding it hostage to their huge social spending bill. Our domestic and foreign policies are in disarray, as shown by Biden’s falling poll numbers. It may be so bad that he needs a victory, so he forces his party to separate the bills and move forward asap with the traditional infrastructure bill needed to rebuild our aging base to enhance our global competitive position. That’s our bet.

The domestic economy is a tale of two cities as services are suffering due to the Delta variant. At the same time, the production end is strong, producing everything that it can limited only by shortages and supply line issues. Key data points reported last week include: index of the consumer in September rose slightly to 71.0, current economic conditions fell to 77.1, and consumer expectations increased to 67.1; August leading indicators rose 0.8% to 117.1, coincident rose 0.2% to 105.9 and lagging increased to 106.3; composite output index fell to 54.5 in September due to shortages and supply line issues, services index fell to a 14 month low at 54.4, manufacturing PMI was a still strong 60.5, and manufacturing output was 55.2; building permits rose 6% in August and housing starts increased 3,9%, but builder confidence fell to a 13 month low, and jobless claims unexpectedly increased to 351,000. It is important to note that consumers see the worst buying conditions in decades due to high prices. And finally, the U.S opened air travel to vaccinated foreigners which should boost growth. The economy is set to reaccelerate as the Delta variant ebbs. Still, shortages and supply line issues will limit growth for the foreseeable future, setting up a very strong and profitable mid-2022 onward as these problems diminish, especially if an infrastructure bill is passed.

The OECD lowered its forecast slightly for global growth in 2021 to 5.7%, keeping China’s growth unchanged at 8.5% (we are lower); Japan at 2.5%; U.S. growth down to 6.0%; India at 9.7% for FY 2022; 4.3% in the Eurozone; Southeast Asia at 3.1% and 4.0% in Australia. The recovery pattern remains uneven due to the coronavirus, shortages, and supply line issues, with increasing inflationary pressures everywhere. The outlook for 2022 growth was lifted to 4.7% as these problems abate.

Investors are focused on China. Not only has growth slowed quickly due to covid, but their largest developer, Evergrande, is on the brink of bankruptcy. It has been here before. While we expect the financial fallout to remain limited to China, it clearly will penalize near-term growth, which had already been under pressure due to the Delta variant. The People’s Bank of China has already injected around $71.0 billion into the banking system and stands ready to do more. We fully expect the PBOC to lower reserve requirements shortly and pump a lot more money into their system. Plans are also being made to step up fiscal support, as jobs are the government's number one priority. Don’t bet against China?

While global growth for 2021 was revised slightly lower due to the spread of the Delta variant, the outlook for growth in 2022 has improved, permitting monetary authorities to look at removing life support tools soon.

Investment Outlook

It is good news that monetary authorities no longer believe that extraordinary measures are needed to support their economies. Tapering does not mean that tightening is on the horizon. 2021 will go down as an extraordinary year as we have had to deal with the pandemic, shortages, supply line issues, geopolitical risks and more. Nevertheless, economies recovered substantially only to slow down over the summer due to the outbreak of the Delta variant. But that is changing as the world gets vaccinated. Better days are ahead.

Investors have not factored into their 2022 projections the positive impacts of ending shortage and supply line issues which ratcheted costs up dramatically in 2021 while also curtailing production/sales. Inventories are at all-time lows everywhere and need to be rebuilt. Infrastructure plans are on the horizon globally on top of significant increases in capital spending and research. All good for growth.

We continue to favor investing in value stocks tied to global economic growth and technology companies riding the wave of digitalization. Companies hurt by shortages and supply-side issues will be the winners next year, too, as these problems abate. Inflation will subside too. We continue to see a steepening yield curve, but it will be held down by large inflows from abroad arbitraging the yield differential.

Getting off life support is a good thing.

1 note

·

View note

Link

#BHEL#F&Obanfortrade#futuresandoptions#ListofstocksunderF&Oban#marketoutlook#Market-widepositionlimit#NationalStockExchange#Nifty#Nofreshpositionsallowed#NSEupdate#PunjabNationalBank#RationaleforF&Oban#SAIL#Sensex

0 notes

Text

best stocks for options trading 2022 Tennessee Even if you think you've got time on your options.

Table of Contents

best stocks for options trading 2022 Tennessee traders will buy 20 or 30 contracts under the same risk parameters.

home options trading course nitroflare Tennessee I'll explain my reason a little bit later.

trading options explained Tennessee Simply learn and use the basics like MACD, support/resistance, trending channels, divergence/convergence, and moving averages.

oex options trading Tennessee Document and Learn From Your Previous TradesEvery trade is a learning experience.

what is trading options Tennessee 00 (the value of the spread minus the premium collected multiplied by the number of contracts times the multiplier).

books on options trading Tennessee You are bearish on the shares or perhaps the sector that the company is in.

basic options trading Tennessee Successful traders DO NOT make random decisions.

billy williams options trading course Tennessee During periods of high volatility.

best stocks for options trading 2022 Tennessee This increase in premiums allows for the investor to trade the option in the market for a profit.

This also includes knowing everything related to them like expiration dates to where they are found on basic option tables.

Conclusion BasicsTrading Options carries nice leverage because you do not have to buy or short the stock itself, which requires more capital. They carry 100% risk of premiums invested. There is an expiration time frame to take action after you buy options. Trading Options should be done slowly and with stocks you are familiar with. I hope you learned some of the basics of options buy side trading, investing and how to trade them. Look for more of our articles.

youtube

Critical Techniques:

professional options trading course by online trading academy Tennessee

options trading tutorial Tennessee

trading naked put options Tennessee

the options course high profit and low stress trading methods Tennessee

delta options trading Tennessee 1 means One option contract representing 100 shares of PKT.

collecting a premium of $0. 57 or a total $1140 (minus fees and commissions). Their goal is to get out of the position when the premium of the spread reaches $0. 29. in which they would be buying back the spread for a profit of $560. Taking profits at 50% of the premium collected is a great level to exit.

the options course high profit and low stress trading methods Tennessee Learning to trade puts or understanding them starts with market direction and what you have paid for the option.

You see, it's important to have some kind of perspective and understanding of the stock or ETF you're trading.

trading options master course ebook pdf Tennessee Those who bought option premium will see the value of those options lose a lot of value because of the volatility crush.

I size the trade to represent my max risk and play the odds. For example, if I were to put on this trade and was risking $1,000 on the trade. I'd sell 4 call spreads which would have a max risk of $972. I'm not a proponent of stopping out of short premium trades. As you know, most options expire worthless. However, there are cases where outliers occur and short premium trades go ITM and end up being losers. By sizing my trades according to the amount I'm willing to lose. I'm not really stressed about any large overnight moves or morning gaps. You see, I've already outlined my line in the sand. In fact, this is one of the problems that I have noticed with those that use option strategies like iron condors. Now, I'm extremely disciplined about following my rules. I know that if option volatility isn't elevated (or rich). it doesn't make sense to add on more risk (to receive a greater premium) because that's how potentially big losses can occur. Some of my clients achieve a great deal of success after a few weeks of learning my simple rules-based approach. However, when some tell me their profits, relative to their account size. I won't hesitate to let them know if they're taking on too much risk and sizing poorly. Of course, some listen. but others will still size up to big.

risks of options trading Tennessee This means, they have a strategy to get into a trade, make adjustments, and exit positions based on SPECIFIC events.

This article will focus on stock options vs. foreign currencies, bonds or other securities you can trade options on. This piece will mostly focus on the buy side on the market and the trading strategies used. What is a Stock OptionAn option is the right to buy or sell a stock at the strike price. Each contract on a stock will have an expiration month, a strike price and a premium - which is the cost to buy or short the option. If the contract is not exercised before the option expires, you will lose your money invested in your trading account from that contract. It is important to learn that these instruments are riskier than owning the stocks themselves, because unlike actual shares of stock, options have a time limit. There are 2 types of contracts. Calls and Puts and How to trade them and the basics behind them. What is a Call Option and how to trade them?A call option contract gives the holder the right to buy 100 shares of the stock (per contract) at the fixed strike price, which does not change, regardless of the actual market price of the stock. An example of a call option contract would be:1 PKT Dec 40 Call with a premium of $500.

best online course for options trading Tennessee After a few trades, you'll begin to recognize key characteristics to why some trades win and why some trades lose.

Learn all the ins and outs of your practice by back-testing historical data, testing current conditions using paper trades, and reading about your favorite trade in books.

simple options trading for beginners Tennessee You see, I've already outlined my line in the sand.

43 x 20 = $48. 60 x the multiplier of 100 shares = $4,860However, the option investor is only willing to risk $1,000 on the position on a $50,000 portfolio. They will buy back the spread for a loss if it gets close to $1. 05. On 7/31/14, the UVXY exploded. moving up more than 16% and closed at $31. 70. The investor felt that this was a good time to sell some premium as the UVXY has a history of sharp moves up followed by sharp declines. Well, on 8/1/14, UVXY continued to climb higher as fears escalated both geopolitically and within the US equity market. It finished the day up nearly 10% and closed at $34. 73. The value of the spread closed at $0. 93. Although the investor was looking at a paper loss of $720, they decided to get out of the position. if UVXY gapped up on the following Monday, it would probably get past the amount they were willing to lose. (Note: UVXY is a product I wouldn't personally sell call spreads on.

options trading forum Tennessee I know that if option volatility isn't elevated (or rich).

10 expiring in an hour. those options that I bought back ended up closing deep ITM. Again, near-term options have the potential from being deep OTM to deep ITM very quickly (and vice-versa). Position sizing is critical for near term options. it doesn't matter if you're buying or selling premium. In many cases, if I do buy premium on an option expiring in a short time frame.

Key Concepts:

options pop trading alerts reviews Tennessee

best options trading Tennessee

options trading course for beginners reviews Tennessee

best options trading Tennessee

1 note

·

View note